To maximize profits for a given risk-return profile of an investor, the following steps are followed:

- Determining the Fair Value of a stock with high accuracy.

- Maintaining control over emotions such as greed and fear through patience, perseverance, and

- A prudent mix of stocks in a portfolio with appropriate weighting for individual stocks, sectors, company size, and business groups.

Our stock investment philosophy

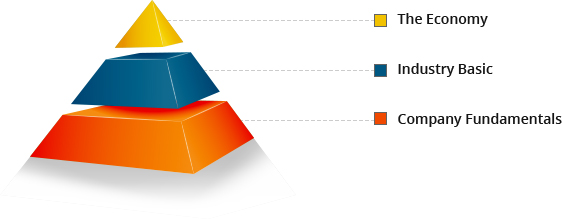

- Our investment strategy follows a bottom-up approach, where the primary focus is on the company fundamentals, followed by the industry and the economy. This method ensures that investment decisions are based on a comprehensive analysis of the specific company, its industry, and general economic conditions.

- The key factor in stock investing is the concept of Fair Value, which is the price paid for the value received. When a stock is available at a price at least 20% below its Fair Value, it is a good opportunity to buy and hold it as long as the perceived value exceeds the stock price. Our expertise lies in accurately determining the Fair Value.

- Investment is both an art and a science. We maintain a watch list of 150 to 180 stocks with sound credentials and bright prospects. Stock is picked from this list as and when the opportunity arises.

- We do not meet with company management, as their passion and quality can be easily judged through long-term financial data, dividend and bonus policies, clients, vision, and other disclosures.

- Sometimes we exit from the stock because a better investment opportunity has been discovered.

- If a stock is held in a portfolio, it is considered a good investment at the ruling price, irrespective of the purchase price.

- Decisions are always made rationally, without emotions.

- We welcome Irrational stock movements; they assist in identifying valuable stocks and exiting from overvalued stocks.

- Our objective is to buy undervalued stocks, hold onto them as long as the story remains intact, and sell when the story ends, resulting in automatic wealth creation. We aim to achieve high returns of about 35% annually, with a low to medium risk.

- There is a 100% correlation between the company earnings and its share price in the long run.

- We are quick to admit mistakes.

Our portfolio management philosophy

Selecting individual stocks is only half the battle in creating a successful investment portfolio.

It's important to consider the combination of stocks that will provide stability and maximize returns. Similar to playing chess, it's not enough to understand the strengths and weaknesses of each piece (stock); you need to utilize their collective power to win.

- A portfolio of 15 to 18 diversified stocks from various sectors, market caps, and business groups almost eliminates the unsystematic risk.

- With more than three decades of investment experience, it's been determined that a single stock should not exceed 8% weightage, and a single sector should not exceed 15% in the portfolio.

- A portfolio's value and growth stocks proportion are adjusted based on market opportunities.

- Always remain fully investing instead of trying to predict market movements.

- Borrowing money is strictly avoided, as even a small 10% debt in the portfolio can consume more than 90% of your time.

- If a company fails to deliver the expected financial results for a few quarters, it should be immediately removed from the portfolio.

- Our investment schemes consist of a mix of large, mid, and small-cap stocks in varying proportions depending on the risk-reward profile of the scheme.